Grow your business with a business credit card from CorePlus Credit Union.

CorePlus Credit Union Business Credit Cards

- Competitive interest rates

- Rewards programs

- Business benefits

Convenience & Accessibility for Managing Everyday Finances

Business Credit Cards with CorePlus Credit Union

CorePlus Credit Union offers a variety of business credit cards to choose from, so you can find the right card for your business needs. Our business credit cards offer competitive interest rates and rewards programs, so you can save money on your business expenses and earn rewards for your spending.

Choose from our popular business credit card options such as low rate, cash back or flexible rewards to find the one that works best for your business.

No matter which card you choose, your business will benefit from important features like:

- Free online expense reporting tools.

- No fee for additional employee cards.

- Mobile payment capability for added convenience.

- Zero Fraud Liability.* You won’t be liable for fraudulent purchases when your card is lost or stolen.

- Cardmember Service available 24 hours a day/365 days per year.

Apply for a business checking account or business credit card today.

[[ Learn More. ]]

Why bank with CorePlus Credit Union?

We make it easy for you to grow your business and stay focused on the operations and management.

- Competitive interest rates. We offer competitive interest rates on our small business credit cards, so you can save money on your business expenses.

- Rewards programs. Our small business credit cards offer rewards programs that allow you to earn points or miles on your business purchases. You can redeem your rewards for travel, merchandise, or other rewards.

- Business benefits. Our small business credit cards offer a variety of business benefits, such as extended warranties, purchase protection, and fraud protection.

- Manage your finances easily. Our online and mobile banking platform makes it easy to deposit checks, transfer funds, and pay bills.

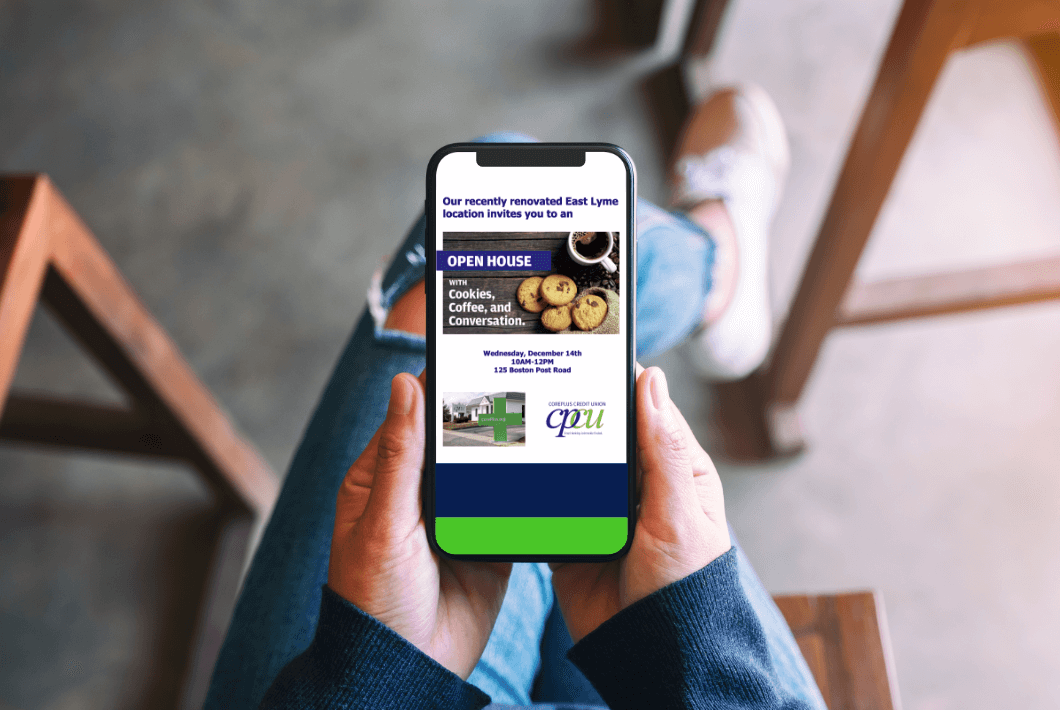

EDIT NEEDED: REPLACE IMAGE BELOW

We’re a member-owned financial institution, which means we’re committed to providing our members with the best possible products and services.

Apply for a business checking account or business credit card today and see how CorePlus Credit Union can help you grow your business!

Should you open a business credit card?

Opening a business credit card with CorePlus Credit Union can be a valuable tool for small business owners. It’s very important to separate business and personal finances. A business credit card makes it easier to track your income and expenses, and it can also help you to comply with tax laws. Popular expenses put on a business credit card include:

- Travel expenses

- Equipment and software

- Advertising

You can also use a business credit card to build a good business credit score, which can help you to get loans and other financing for your business. Business credit cards with fraud protection or other benefits can also help protect your small business. Finally, business credit cards offer rewards and bonuses that many personal credit cards do not. This includes earning more points or miles, and redeeming rewards for travel or merchandise.

If you are a small business owner, consider opening a business credit card to grow your operations!

About Elan Financial ServicesElan Financial Services provides zero fraud liability for unauthorized transactions. Cardholder must notify Elan Financial Services promptly of any unauthorized use. Certain conditions and limitations may apply.The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc., and Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Business Credit Card

CorePlus Credit Union offers a variety of business credit cards to choose from, so you can find the right card for your business needs. Our business credit cards offer competitive interest rates and rewards programs, so you can save money on your business expenses and earn rewards for your spending.

Apply Online

Business Checking Account

With our Small Business Checking Account, you can easily deposit checks, transfer funds, and pay bills. You can also get free access to our network of ATMs nationwide.

Apply Online