Get the financial support you need to grow your business.

CorePlus Credit Union Business Banking

- Small Business Checking

- Business Credit Card

- Local Business Solutions

Small business banking through your local credit union.

Business Banking with CorePlus Credit Union

CorePlus Credit Union offers a variety of business banking products and services to help you manage your finances and grow your business. We offer a business checking account with no monthly maintenance fees and no minimum balance requirement. We also offer a variety of business credit cards with competitive interest rates and rewards programs.

Business Checking

- No monthly service fee

- First 50 transactions free, $0.25 per transaction thereafter

- Online Banking

- Online statements

- Mastercard debit card

Business Credit

- Free online expense reporting tools.

- No fee for additional employee cards.

- Mobile payment capability for added convenience.

- Zero Fraud Liability.* You won’t be liable for fraudulent purchases when your card is lost or stolen.

- Cardmember Service available 24 hours a day/365 days per year.

Take your business to the next level!

Visit a CorePlus branch to apply for a business checking account or business credit card today.

Why choose CorePlus Credit Union for your business banking needs?

CorePlus has been trusted in the community since 1936. As a credit union, we are owned by our members; those who live, work, and worship in the same community where you run your business. As fellow community members ourselves, we want to see your business flourish. Our Small Business Checking account offers competitive benefits

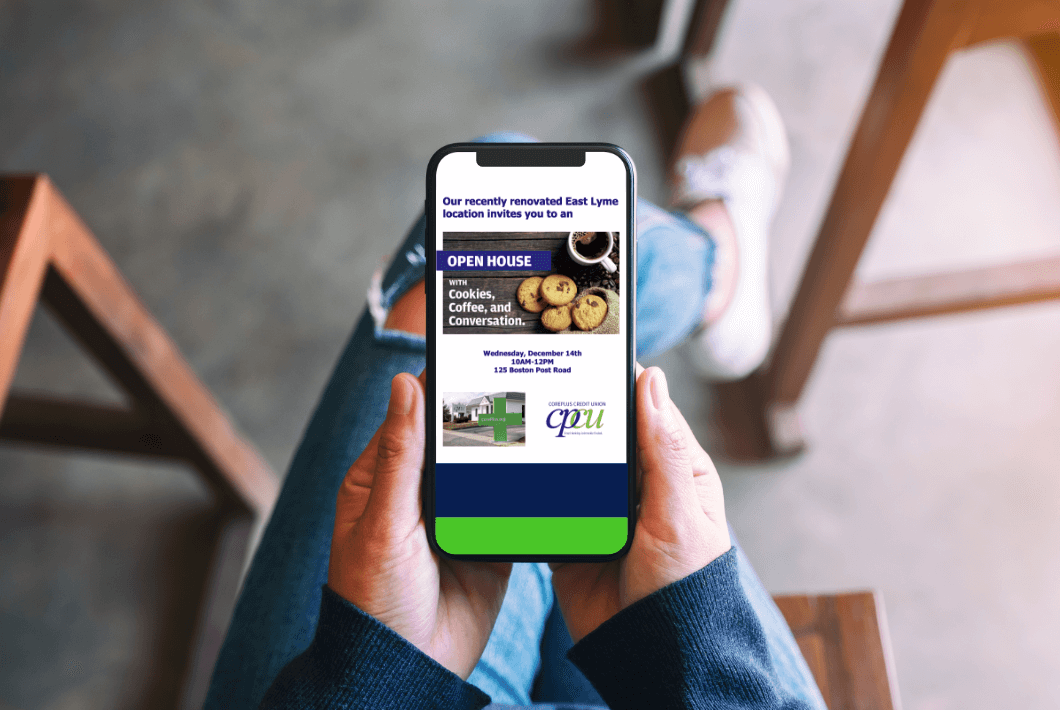

Visit one of our branches to open a new business checking account.

Business Credit Card

CorePlus Credit Union offers a variety of business credit cards to choose from, so you can find the right card for your business needs. Our business credit cards offer competitive interest rates and rewards programs, so you can save money on your business expenses and earn rewards for your spending.

Apply Online